Synchology

Synchology Banking Platform

"They work really hard, but they’re also a lot of fun. They take everything they do very seriously. It was a joy to interact with them and that makes things easier when things get stressful."

Doug Bobenhouse

President / Co-Founder

Powering Synchology's White-Label, Multi-Tenant Prepaid Debit Platform with Eight Bit Studios

Founded in Chicago, Synchology is a forward-thinking financial startup that's all about shaking up the online and mobile banking scene. They're in the business of giving brands the tools they need to offer slick payment services. With a knack for making banking simple and user-friendly, Synchology is busy crafting online and mobile banking experiences that are not just smart, but also super intuitive. They're on a mission to change the way we think about banking, blending cool tech with designs that just make sense for today's users and brands.

Overview

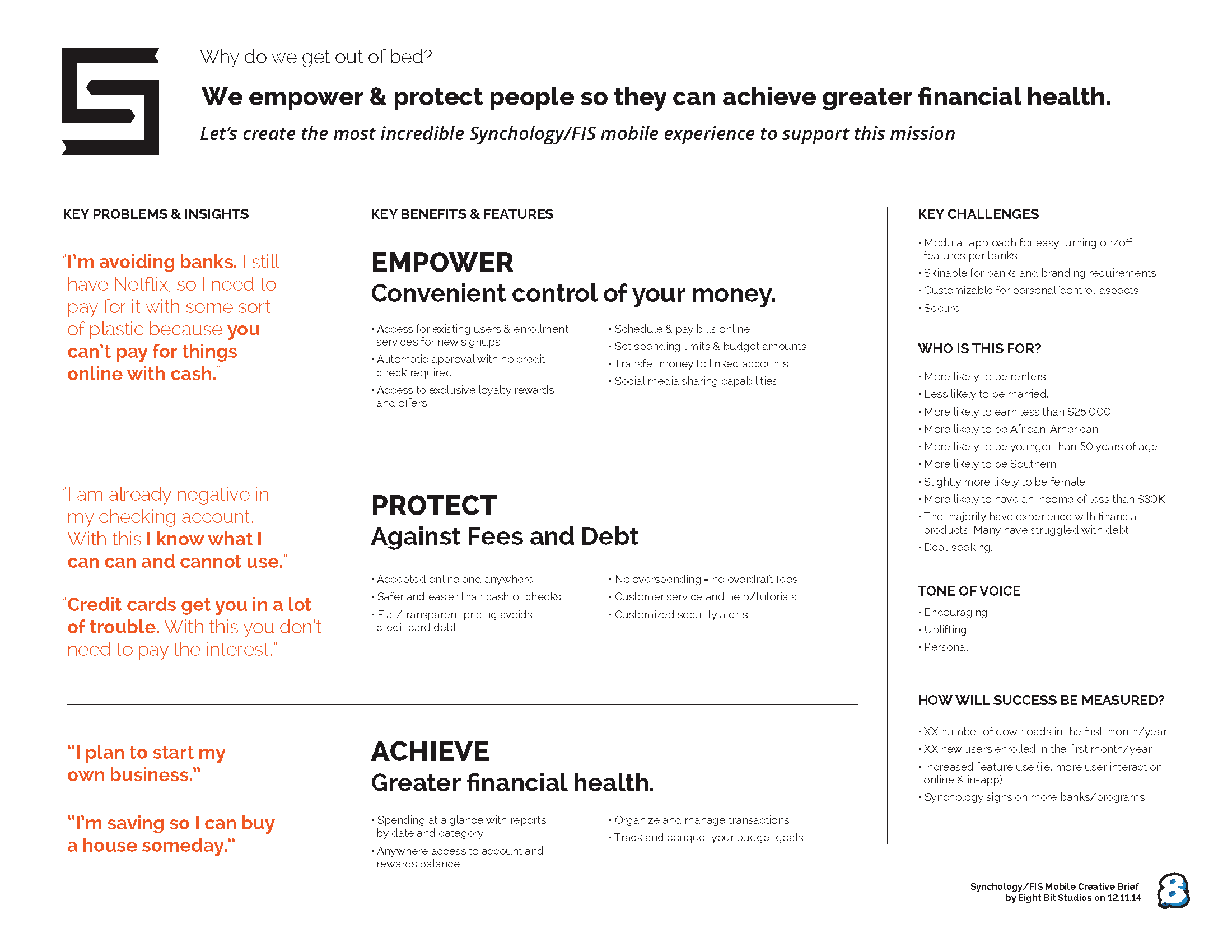

In a world where traditional banking practices are increasingly seen as outdated, Synchology and Eight Bit Studios joined forces to embark on a mission to modernize the prepaid debit space. They aimed to enhance their platform with intuitive data visualization, seamless user experiences, and white-labeling capabilities across Synchology’s branded programs.

Ask

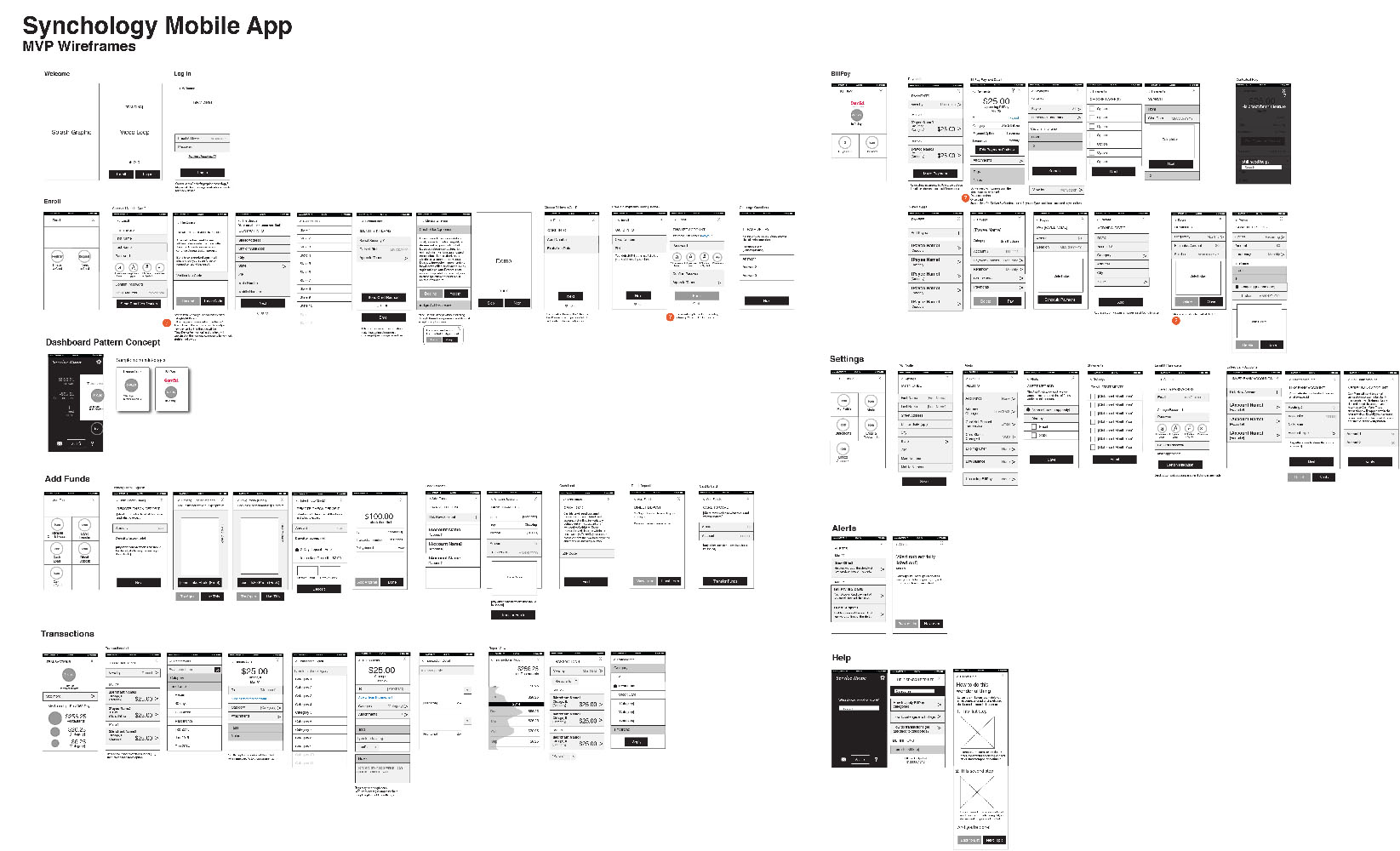

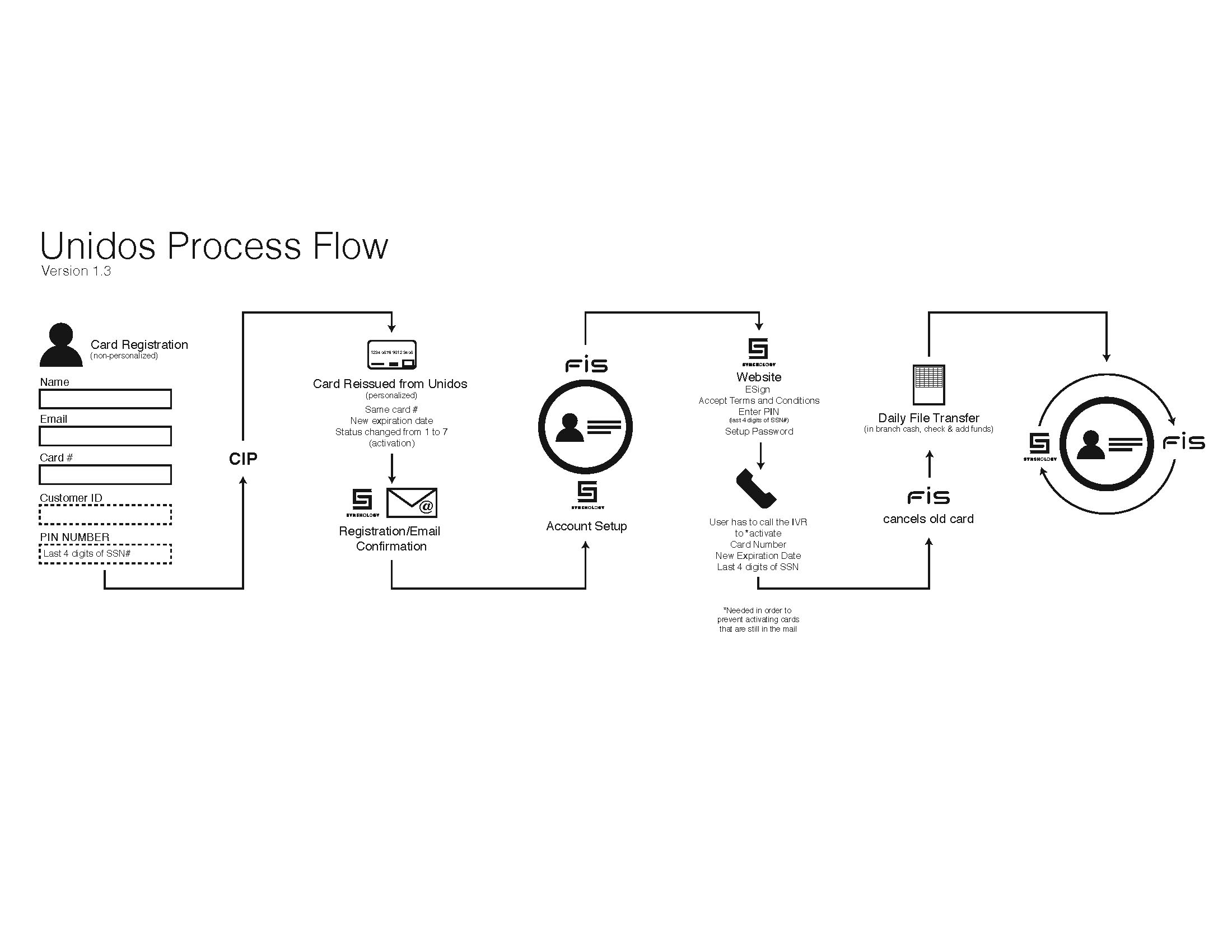

Eight Bit Studios was engaged by Synchology for dual objectives: to manage and enhance a substantial existing codebase and to conceptualize, design, and develop scalable mobile applications for iOS and Android. The project required a deep focus on custom solutions for payment processing, security, and user authentication, tailored to each new client. Integral to this role was leveraging their expertise with FIS APIs for transaction handling and integrating various rewards and loyalty platforms to enrich the user experience.

Solution

In addressing Synchology's comprehensive needs, Eight Bit Studios embarked on a two-pronged approach. Initially, the focus was on fortifying and customizing the existing platform, followed by the development of intuitive and feature-rich mobile applications.

Platform Enhancement:

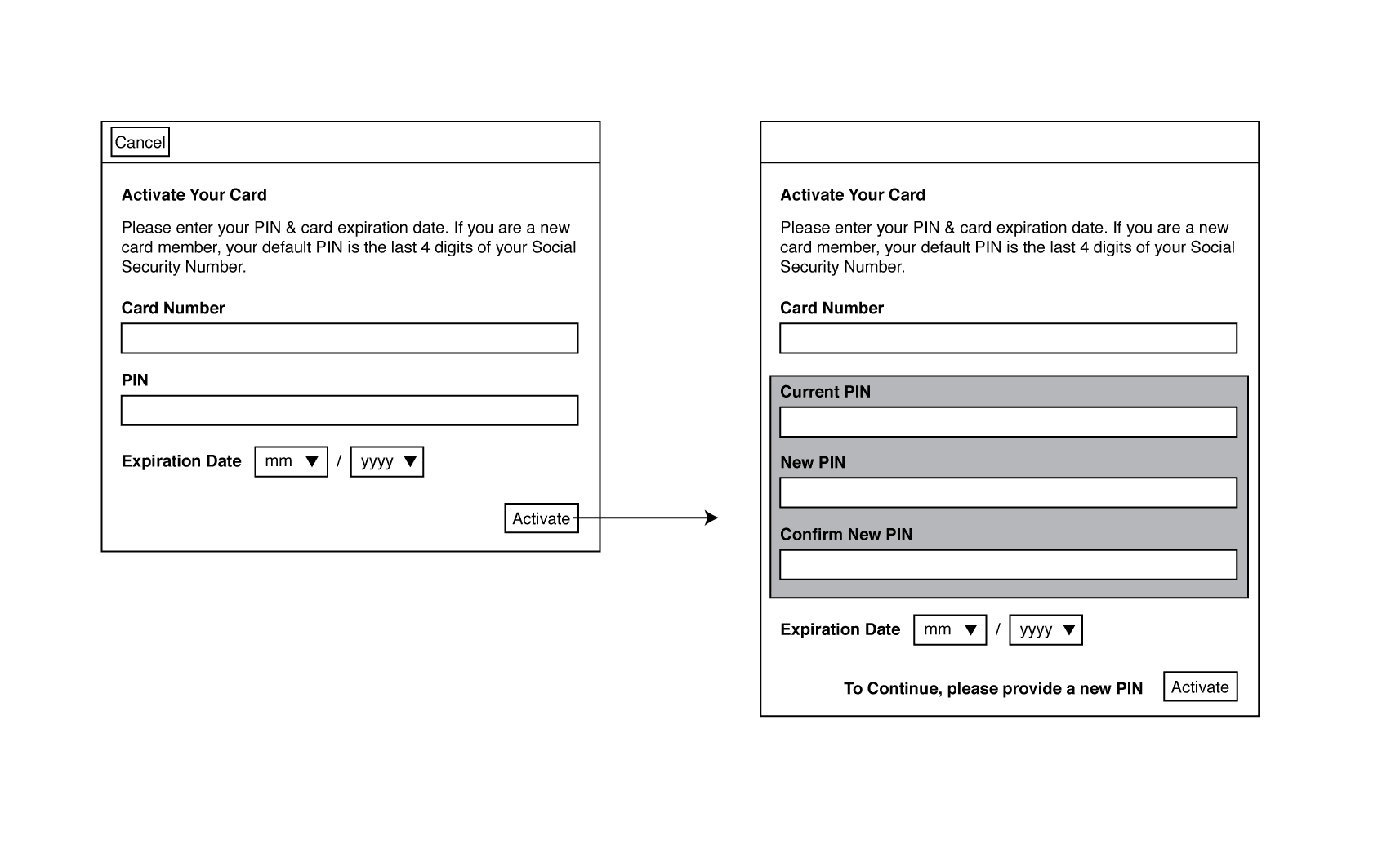

Upgraded and maintained the core codebase for robust functionality.

Tailored custom solutions for secure transaction processing and user authentication.

Integrated various financial institutions into the platform.

Mobile App Development:

Designed and developed native iOS and Android apps.

Ensured seamless integration with FIS APIs for effective transaction handling.

Incorporated rewards and loyalty programs for enhanced user engagement.

Results

Successful Platform Launch: The white label solution was successfully launched, meeting the desired benchmarks for functionality and user experience.

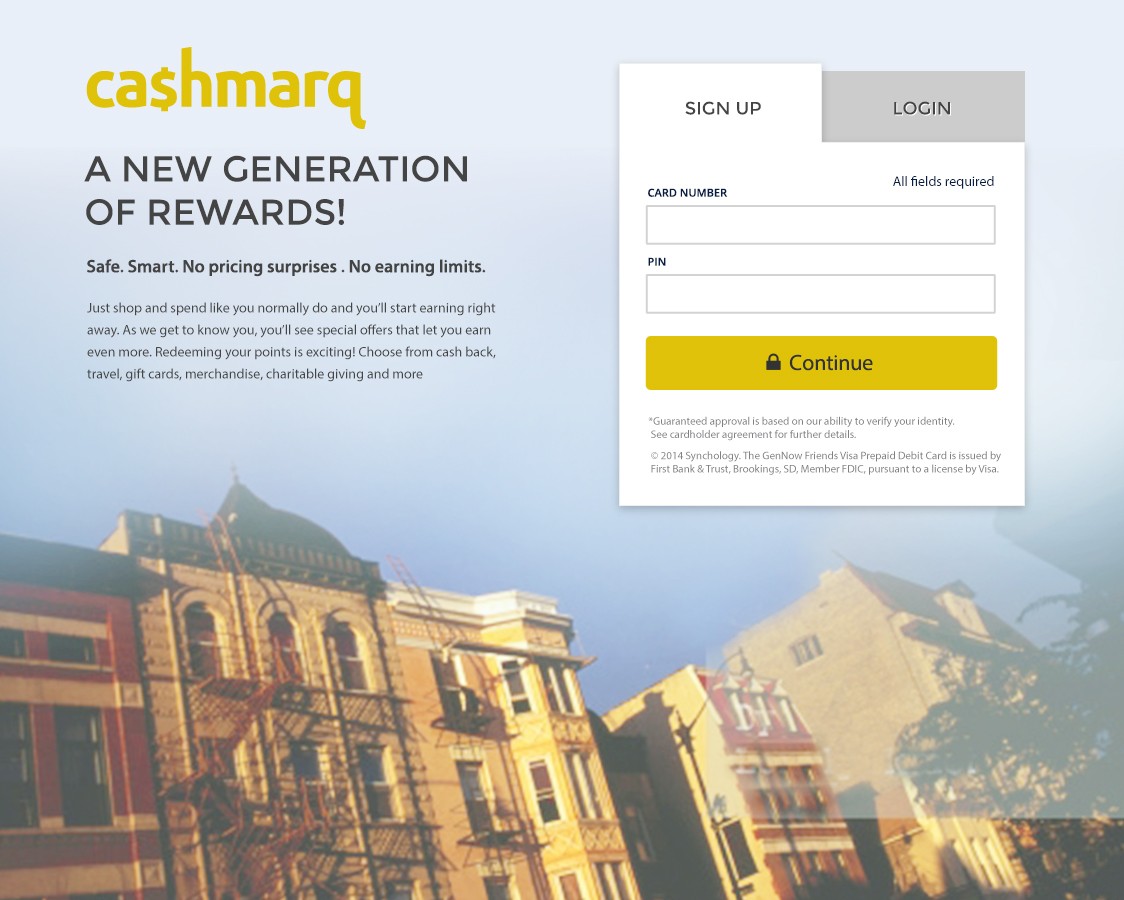

Activated 6 branded payment programs.

Positive Market Reception: The platform received favorable feedback from users for its seamless integration of banking and loyalty features.

Ongoing Expansion: Continuous enhancements and expansions into mobile banking, demonstrating the scalability and adaptability of the solution.

Our Approach

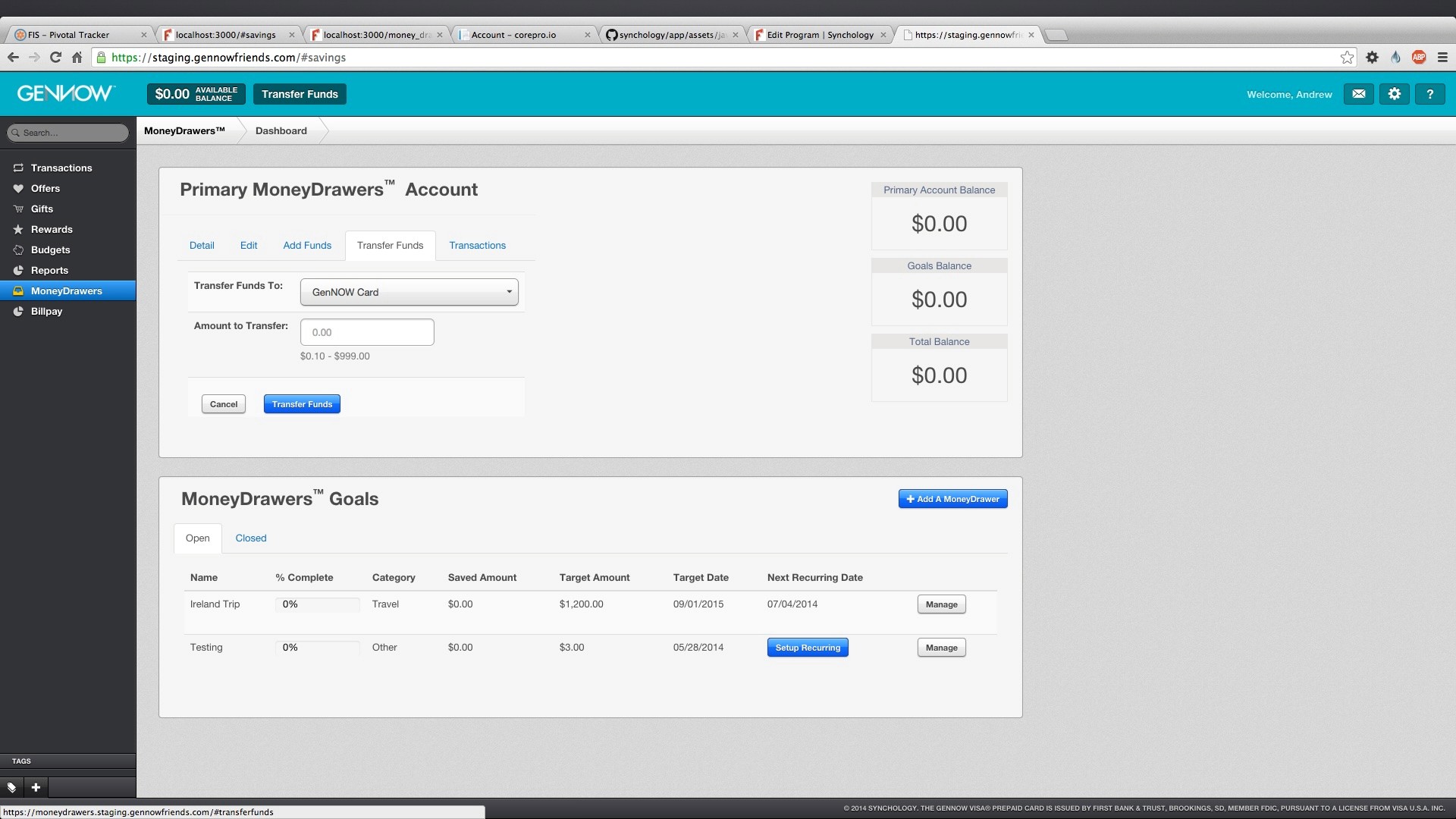

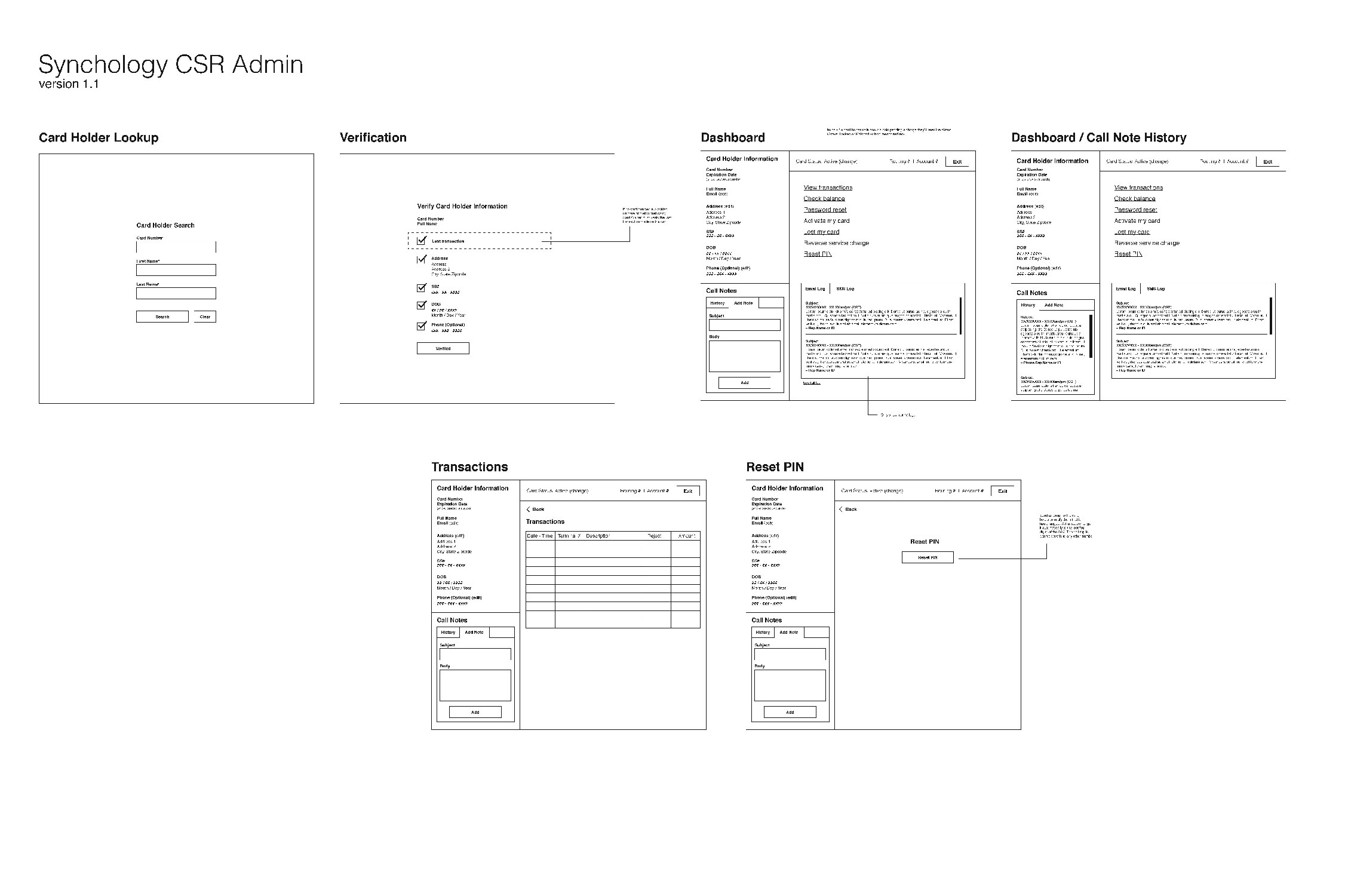

Platform Maintenance and Enhancement

Focused on the continual improvement and maintenance of Synchology’s platform.

Programming efforts to maintain and update the current platform.

Onboarding new clients with custom-tailored solutions.

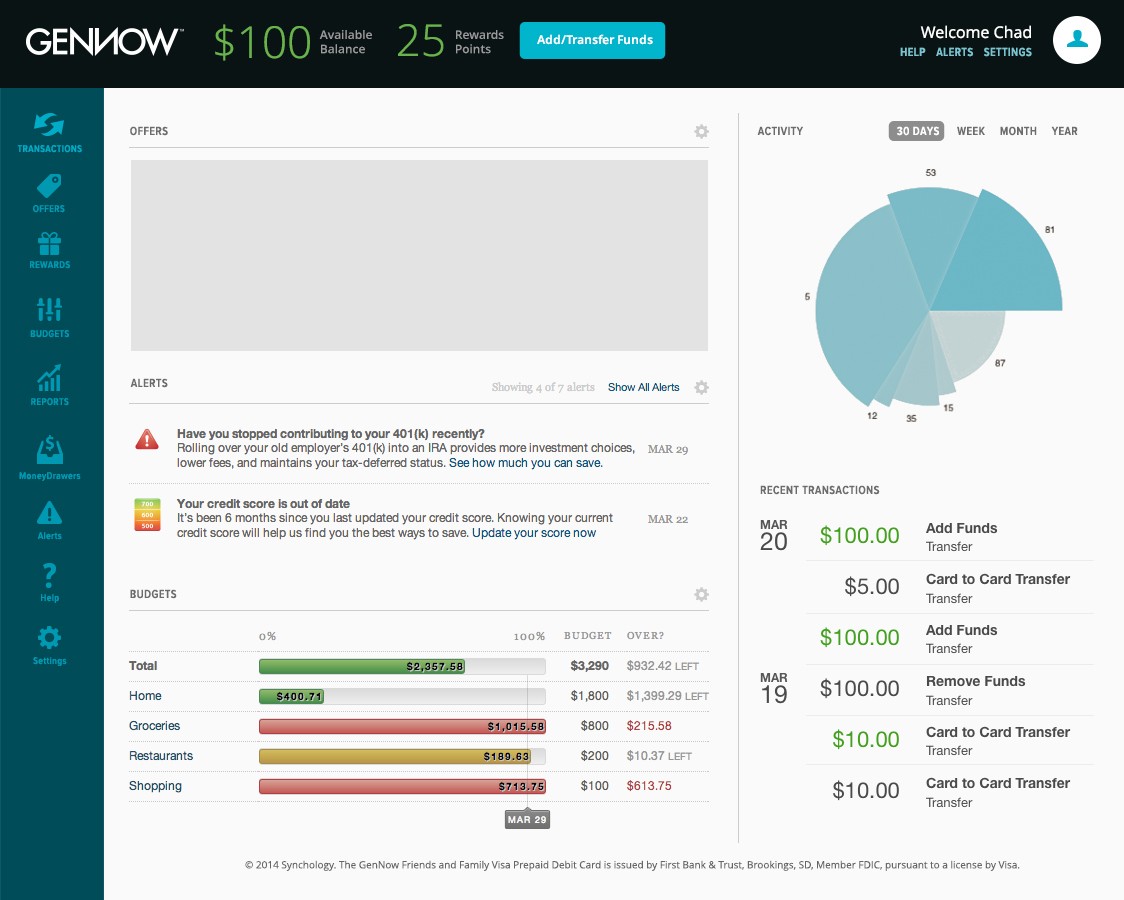

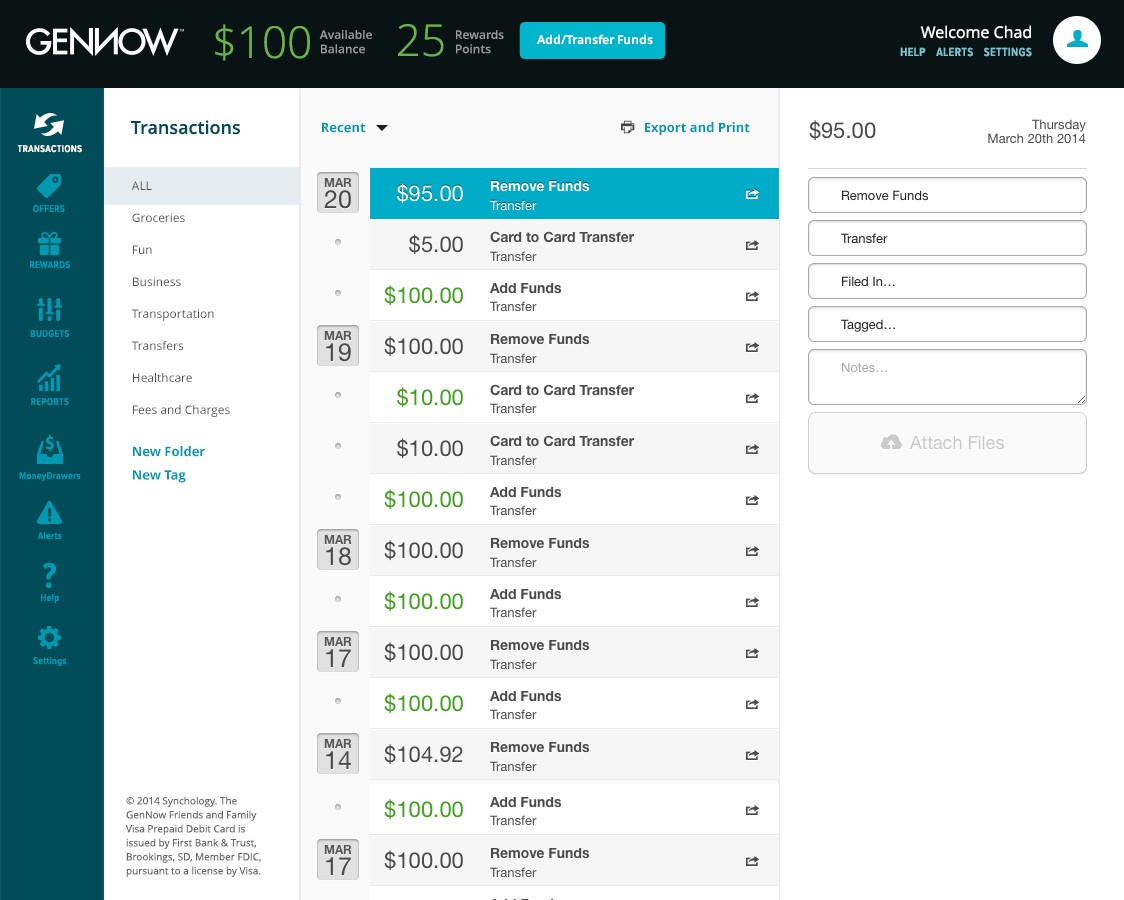

Addressing challenges in data visualization and user interaction.

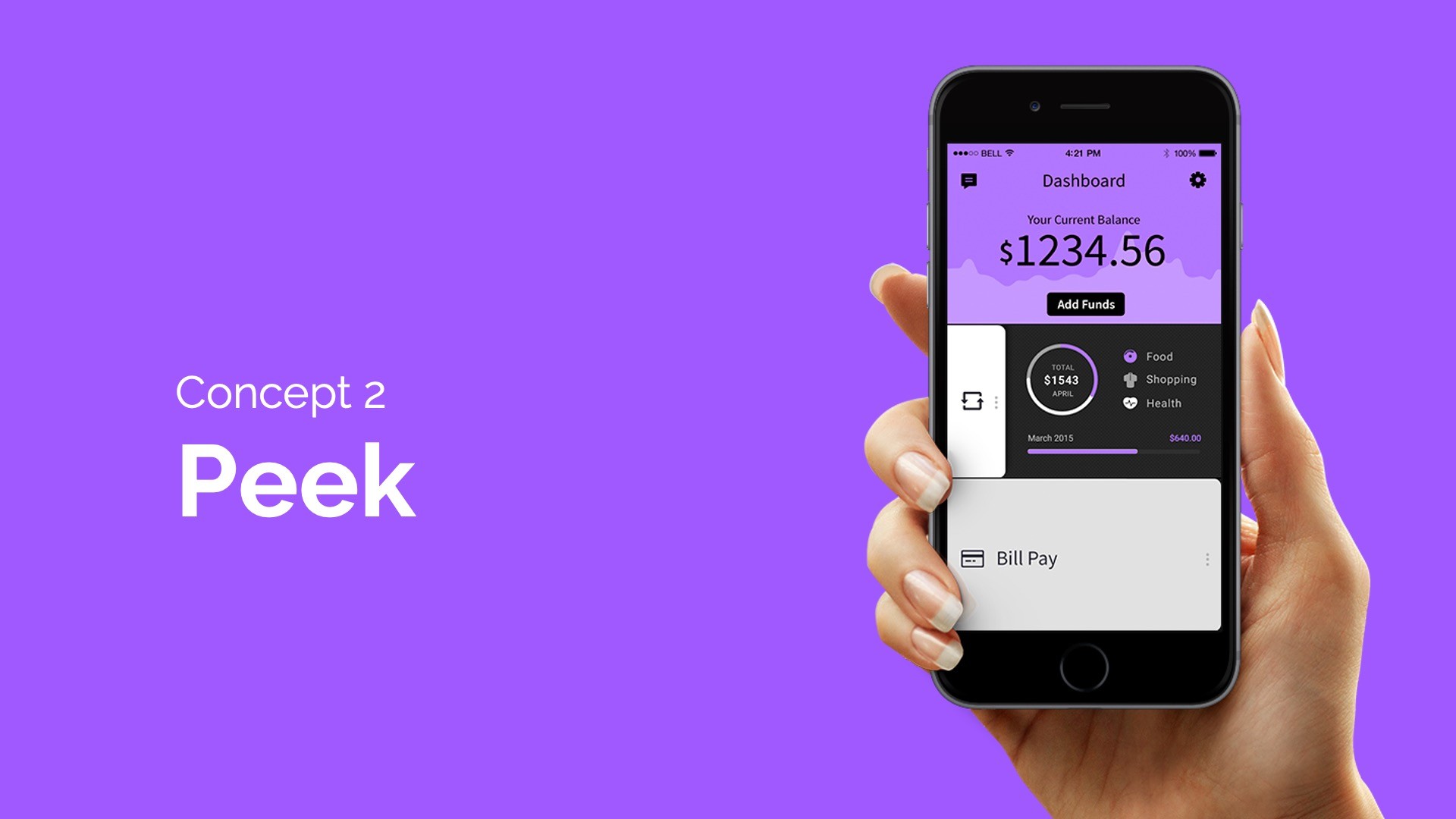

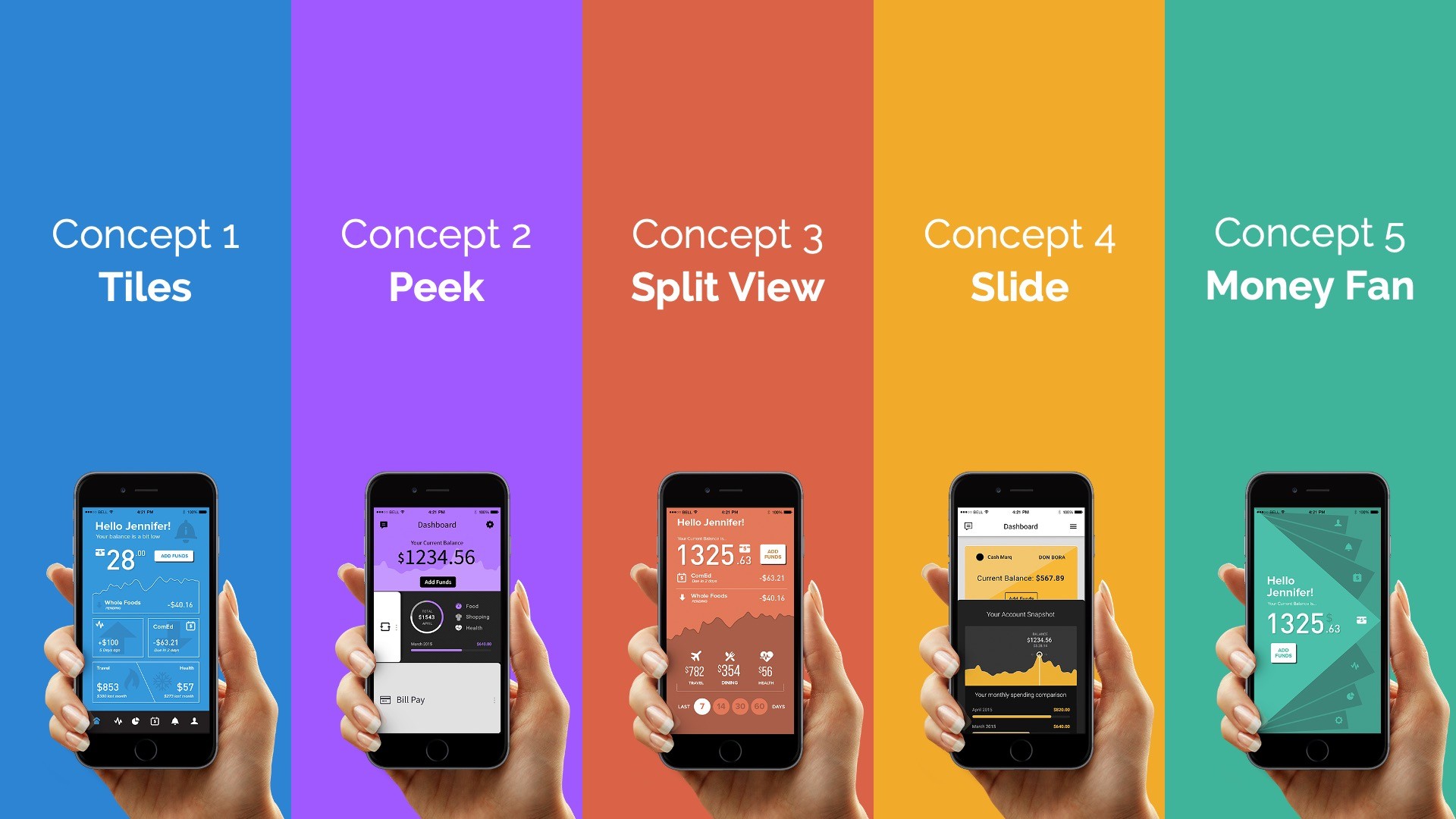

Redesign and Mobile Development

Dedicated to modernizing Synchology's user interface and launching their first mobile application.

Undertook a complete redesign of their application, focusing on user-friendly dashboards.

Developed Synchology's first mobile product, enhancing accessibility and engagement.

Integrated new features and functionalities tailored to client needs.

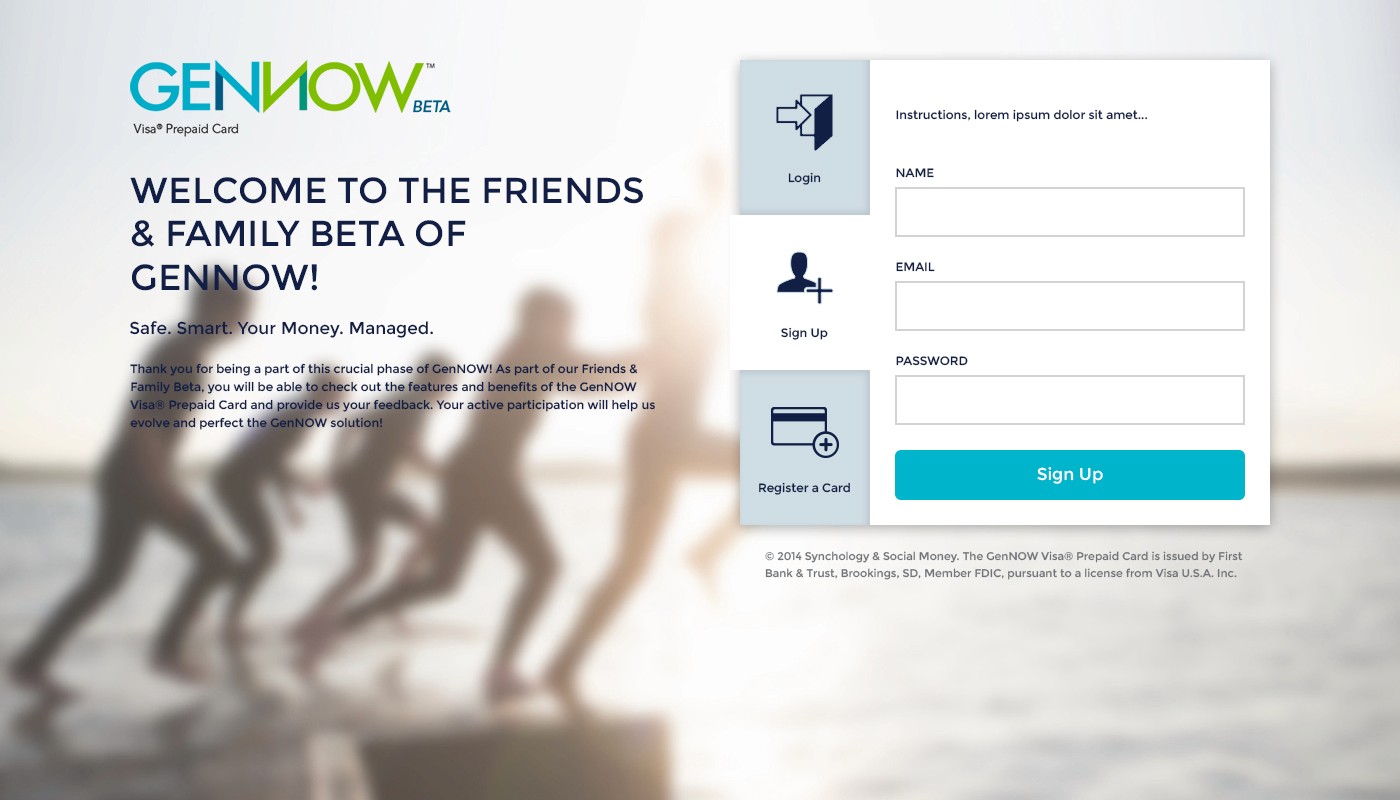

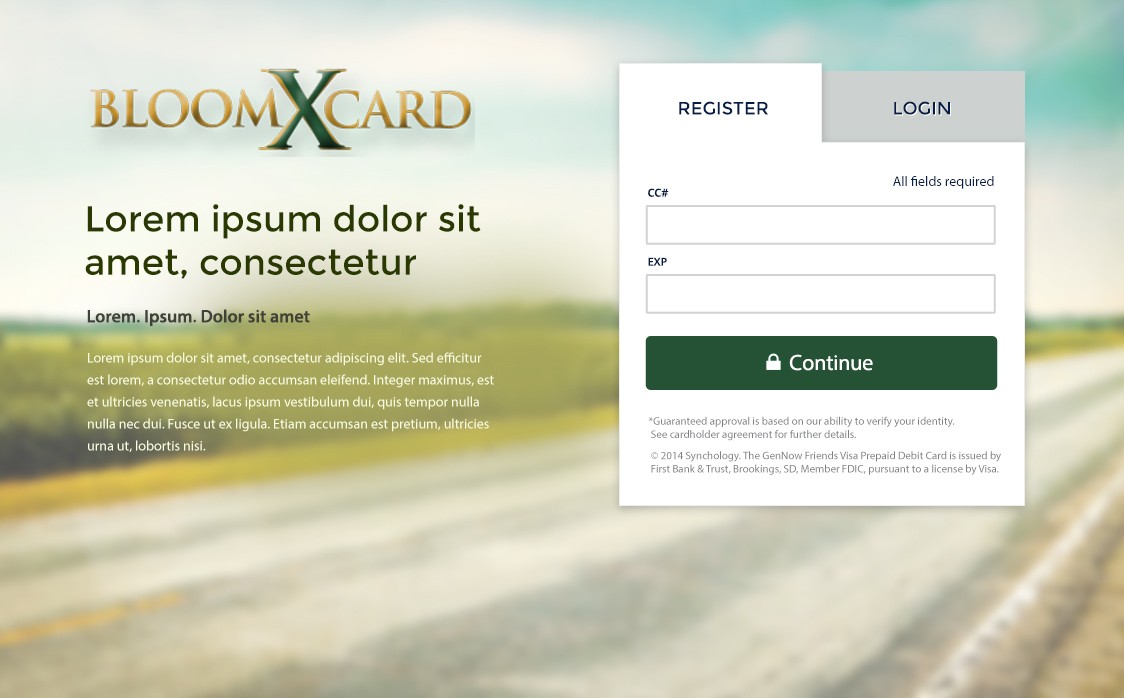

White Labeling and Branding System

Developed a scalable white-label solution, enabling customization for various branded programs.

Implemented a branding system that could be managed through key web platform features.

Ensured consistency and flexibility across different branded payment programs.

Aligned technological solutions with smart design decisions for seamless brand integration.

Technological Advancements and Migration

Planned and initiated a migration to a Service-Oriented Architecture to support future scalability.

Prepared for a significant architectural shift beginning in 2016.

Ensured the new architecture would support a growing suite of financial products.

Focused on building a robust, scalable infrastructure to meet evolving demands.